All Categories

Featured

Table of Contents

For those interested in investing in property, getting tax liens is just one alternative. Buying a home in foreclosure or buying a home at a public auction can also be beneficial financial investment chances. If you are still interested in building tax obligation liens, it is suggested that you consult your realty agent or monetary advisor.

Each year the Duval County Tax Collector carries out a tax obligation certification sale. The annual tax certification sale is a public sale of tax obligation liens on overdue actual residential property tax obligations.

Keep in mind,. A tax certificate is a lien on the home; It does not convey title to the land. Tax obligation Certifications offered through this tax sale need to be held 2 years prior to a tax obligation action application can be submitted. Bidding is based upon the quantity of yearly rate of interest to be made by the certificate buyer.

Adjustments to the tax roll can cause decreases in assessed value, as can changes such as: fire, removal of a mobile home, or stricture. As a tax obligation certification investor, you are accountable for investigating the residential or commercial properties on which you acquire liens. Certificates will be granted to the prospective buyer happy to approve the most affordable price of passion on the investment.

It is the prospective buyers' duty to guarantee they are bidding on the correct parcels. Once a certification has actually been awarded, it will certainly not be terminated as a result of an error, or change of mind, by the prospective buyer. The prospective buyer will certainly be required to spend for all the certificates they have won within 2 days after the close of the tax sale.

Tax Lien Invest

The Duval County Tax Certification Sale makes use of a straight proposal auction layout. A straight quote auction takes the most affordable rate of interest went into and awards the certificate at that price. The public auction is not proxy design in which a certification is awarded at 0.25% less than the next most affordable proposal. In Duval Area, if bidder one and bidder two are both bidding on the exact same home and prospective buyer one puts his cheapest quote at 12% and prospective buyer 2 places his most affordable bid at 0.25%, bidder 2 will win the certification with a price of 0.25%.

Keep in mind that is a zero percent bid is gotten in the certification will certainly be awarded at a zero percent rate. In the situation of a tie at the winning bid rate, the system establishes the victor of the certification making use of an arbitrary number generator. A prospective buyer will never be granted a certification at a lower rate than his defined minimum acceptable rate.

The specific registering need to be the real "proprietor" of the SSN. (It can not be a kid's name with the moms and dads SSN). For most "non-individuals" (i.e. is tax lien investing a good idea., depend on, estates, partnerships, and comparable entities), the tax identification number (TIN) is the Employer Identification Number (EIN) for the company. The TIN you use on the Prospective buyer Details kind have to match the name shown on your social safety and security card or Employer Identification type.

Investing In Real Estate Tax Liens

This details is also transmitted to the Irs as called for by law. Bidders have to position funds on down payment in order to participate in the tax obligation sale. A deposit in the quantity of 10% of the overall value of certificates you desire to acquire need to be obtained by the days specified on the tax sale site.

Guidelines on how to send out funds get on the tax sale website. If you do not have the funds on down payment you will not be awarded any type of tax certifications, even if you have actually bid on them. If you put $10,000 on down payment you may be granted as much as $100,000 well worth of certifications.

Down payments should be obtained 5 company days before the tax sale. Each bidder is required to pay in complete less the down payment for all granted certificates within two days of the close of the auction. The exact date and time will certainly be available on the tax sale site. If more cash has actually been gathered than certificates awarded, the excess funds will be reimbursed within 14 company days after the close of the sale. how to start tax lien investing.

Unfair or misleading call by the owner of a tax obligation certificate to a building owner to obtain payment is an unreasonable and deceptive trade practice, as referenced in s. 501.204 (1 ), regardless of whether the tax certificate is redeemed. If the building owner later on retrieves the certificate in reliance on the deceptive or unfair practice, the unfair or deceitful contact is workable under applicable laws prohibiting fraud.

As a tax obligation certificate financier, you are liable for researching the buildings on which you buy liens. A bidder should hold the tax lien certification for a minimum of two (2) years from April 1 of the certification issue year to apply for Tax Deed to the home.

For an investor to get a Tax Deed to the residential property the investor have to hold the tax lien certificate for a minimum of two (2) years from April 1 the year the certification was first provided. As an instance, a 2006 tax certificate (2005 tax obligation year) bought at the tax obligation certificate sale, would certainly have to be held up until April 1, 2008, before the certification holder could relate to bring the home to a tax act sale.

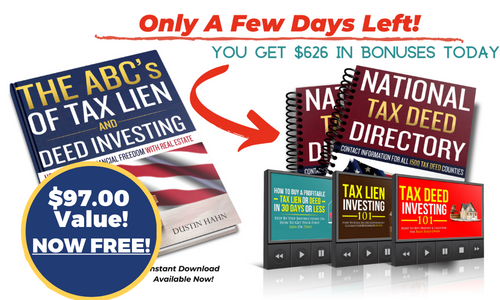

Tax Lien And Tax Deed Investing

It is the certificate owner's responsibility to guarantee the legal status of the property. If it is identified that the process of "quieting title" would certainly require to be done, it is the certification holder's responsibility to complete and pay all associated costs. Must the tax obligation certification be retrieved, the investor will certainly obtain a refund for the acquisition quantity, plus the rate of passion quote at the time of the sale.

A minimum of 5% rate of interest will be billed unless the certificate was bid a no percent. Phase 197.482( 1 ), Florida Statues mentions the following: "After the expiry of 7 years from the date of issuance, which is the date of the initial day of the tax certificate sale as promoted under s.

Every year in the Autumn, the Treasurer's Workplace will certainly release a checklist of residential properties that are delinquent on their real estate tax. If those accounts remain overdue, a tax obligation lien sale will be held to financiers going to pay the quantity due. The starting proposal is the tax obligations, passion, and charges owed.

A premium is a quantity paid over and over the quantity of overdue taxes, rate of interest, and charges owed. The premium bid is not component of the investment, passion is not paid on costs and will not be refunded or returned. At the final thought of the sale, the overall advertised amount plus the costs bid will certainly schedule.

Latest Posts

Excess Sales

Unpaid Property Taxes Near Me

Tax Auction Homes Near Me