All Categories

Featured

You will currently need to look for the "overdue tax" line for the previous tax year to figure out the quantity to sub-tax. A redemption declaration is an additional source utilized to identify sub-tax purchase quantities.

Realty can be a profitable financial investment, but not everybody desires to manage the troubles that usually include owning and preserving rental building (tax lien investing illinois). One method to buy property without being a proprietor is to purchase real estate tax liens. Every year, home owners in the U.S. stop working to pay concerning $14 billion in real estate tax, according to the National Tax Obligation Lien Association

Real Estate Investing Tax Lien Certificates

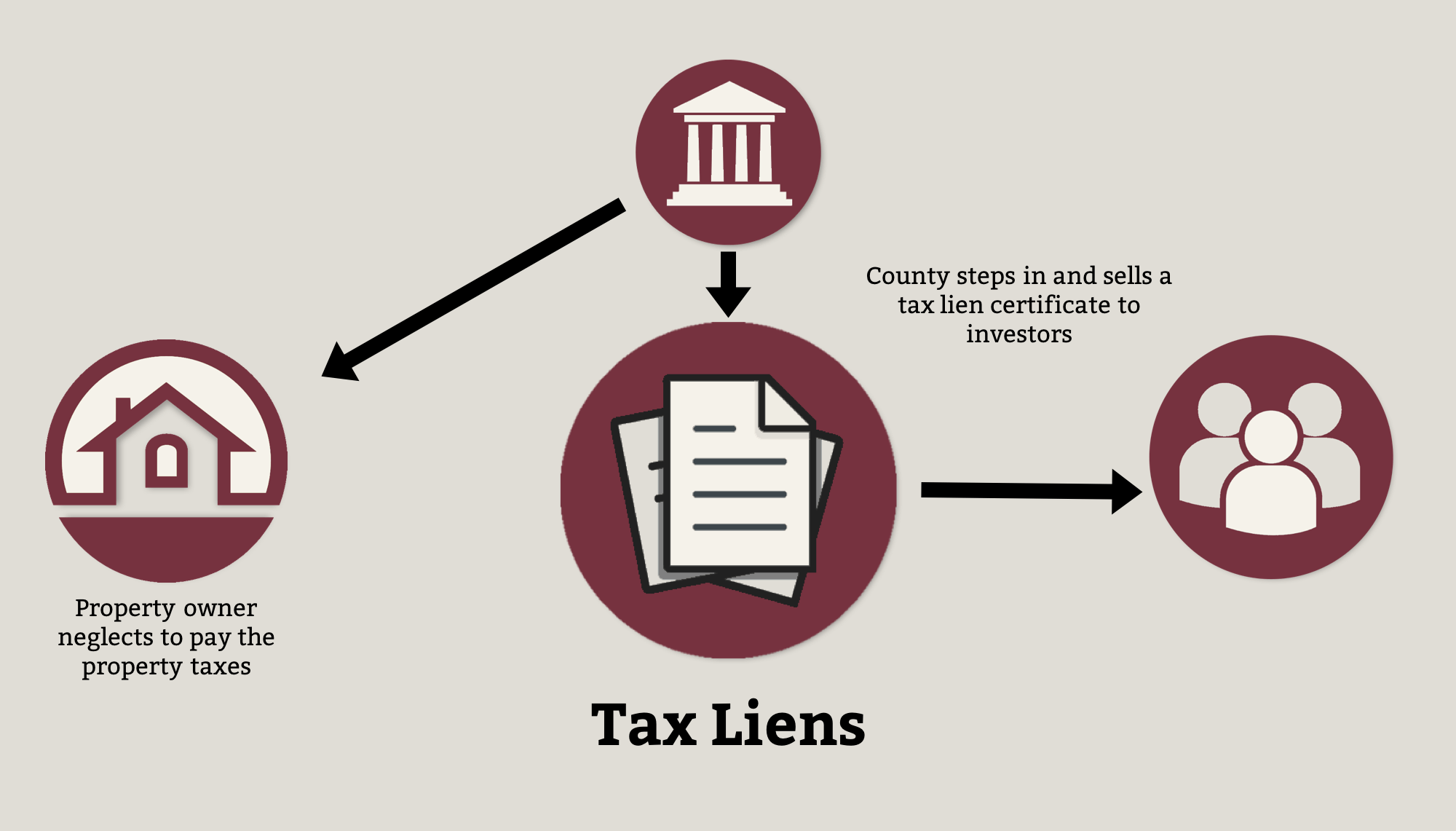

When a house owner drops behind in paying residential property taxes, the region or community may place tax obligation lien against the residential or commercial property. This makes certain that the building can't be refinanced or sold until the tax obligations are paid. As opposed to awaiting repayment of taxes, federal governments in some cases decide to market tax obligation lien certificates to exclusive capitalists.

As the owner of a tax obligation lien certification, you will certainly get the rate of interest payments and late fees paid by the home owner. If the house owner does not pay the taxes and penalties due, you have the legal right to foreclose on and take title of the home within a specific amount of time (normally two years). So your revenue from a tax lien financial investment will certainly come from one of two resources: Either interest repayments and late charges paid by homeowners, or foreclosure on the residential or commercial property occasionally for as little as pennies on the buck.

The rates of interest paid on tax liens differs by state, yet it can be as high as 36 percent yearly. One more benefit is that tax obligation lien certifications can occasionally be purchased for as little as a few hundred bucks, so there's a low barrier to entrance. As a result, you can expand your profile and spread out your threat by buying a number of different tax lien certifications in various realty markets.

For instance, if the home owner pays the passion and penalties early, this will minimize your return on the financial investment (tax lien investing in texas). And if the homeowner proclaims insolvency, the tax lien certification will be subservient to the mortgage and federal back taxes that schedule, if any kind of. Another danger is that the value of the domestic home might be less than the quantity of back tax obligations owed, in which case the house owner will certainly have little motivation to pay them

Tax obligation lien certifications are usually sold via public auctions (either online or face to face) carried out each year by county or community taxing authorities (tax lien investing canada). Readily available tax obligation liens are usually released numerous weeks before the auction, along with minimal quote amounts. Check the websites of regions where you want acquiring tax liens or call the region recorder's office for a checklist of tax obligation lien certifications to be auctioned

Certificate In Invest Lien Tax

Remember that the majority of tax obligation liens have an expiration day after which time your lienholder legal rights end, so you'll need to move rapidly to boost your chances of optimizing your financial investment return. Tax lien investing can be a successful means to purchase realty, yet success calls for thorough research and due diligence

Firstrust has even more than a decade of experience in supplying financing for tax obligation lien investing, together with a devoted group of licensed tax lien professionals that can aid you leverage prospective tax lien spending opportunities. Please contact us to find out more about tax obligation lien investing. FT - 643 - 20230118.

Latest Posts

Excess Sales

Unpaid Property Taxes Near Me

Tax Auction Homes Near Me